Filter Categories

All

Newsroom

Sort By Date

Central Indiana Land Trust is a 501(c)3 nonprofit, and all gifts are tax deductible. Our Tax ID Number is 35-1816493.

Donate Stock or other appreciated securities

Donating appreciated assets such as stocks, bonds, or mutual funds can be a tax-efficient way to make your donation to the Central Indiana Land Trust go further and protect more nature.

Our stock gift instruction document includes all the information your stockbroker or financial institution will need to help you make a gift of stock or other appreciated securities. It also provides step-by-step directions on how to make this type of gift.

Download CILTI Stock Gift information

Why would someone make a gift of stock?

Donating appreciated stock has a special benefit that doesn’t apply to regular cash donations. You can avoid paying capital gains tax on the appreciation of the stock you donate.

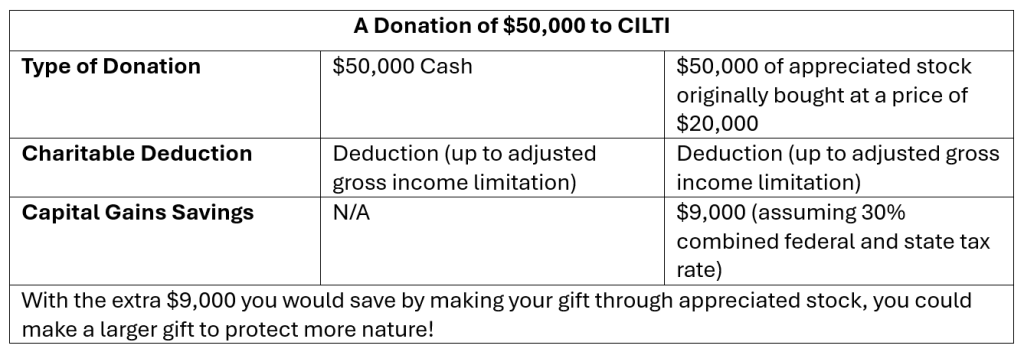

Because CILTI is tax exempt, it won’t pay capital gains taxes on the donated stock. This allows you to make a larger gift through appreciated stock than you might have given in cash. To illustrate this, consider this example comparing a $50,000 gift through a cash donation or a donation of appreciated stock:

Give from your IRA

If you are over the age of 70 ½, there is a tax-effective way for you to support CILTI through a charitable IRA Rollover. This allows you to disburse funds directly from your IRA to CILTI without incurring taxable income yourself. Additionally, these charitable gifts may fulfill all or a portion of the required minimum distributions (RMD) that are disbursed annually from your IRA. You can contact the institution that holds your IRA to ask how you can initiate this type of gift.